Introduction

The financial industry is one of the most customer-centric sectors, where providing excellent service is not only essential for customer retention but also for attracting new clients. In recent years, Artificial Intelligence (AI) has become a transformative force within the banking sector, particularly in the area of customer service. Through the use of AI customer service bots and smart advisors, banks have begun to drastically reduce their reliance on human customer support agents while also improving response efficiency, enhancing customer engagement, and boosting overall satisfaction.

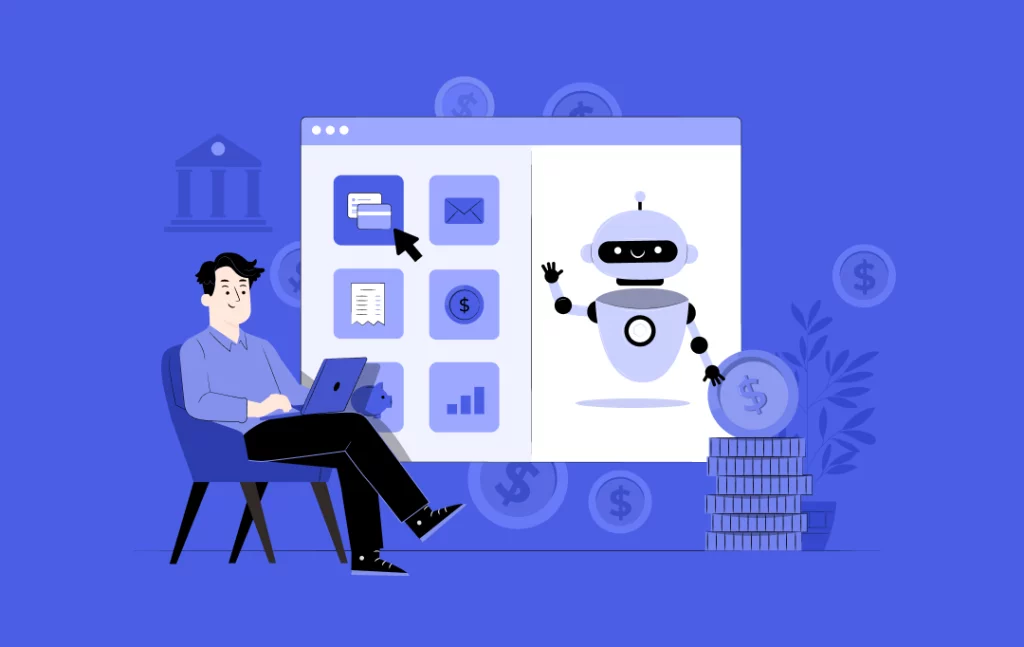

AI-powered tools, particularly chatbots and virtual assistants, have demonstrated remarkable abilities in handling routine inquiries, managing transactions, and providing personalized financial advice. These tools are 24/7 operational, capable of responding instantly to customer queries, thus reducing the customer wait time and improving operational efficiency. Moreover, the automation of common customer service tasks allows banks to lower operational costs while maintaining a high level of service quality.

However, AI-powered customer service is not just about cost reduction; it is also about creating a more engaging, convenient, and personalized experience for customers. By leveraging data from customer interactions, AI systems can provide recommendations tailored to individual needs, predict financial behavior, and offer proactive solutions, further enhancing customer satisfaction and retention.

This article explores how AI-driven customer service bots and smart advisors are revolutionizing the banking industry. It will cover the benefits of these technologies, their impact on operational costs, the challenges they address, and the ways in which they help banks improve both customer engagement and loyalty. We will also examine case studies of leading banks successfully implementing these technologies.

The Evolution of Customer Service in Banking

Traditional Customer Service Models

Traditionally, banking customer service has been primarily human-driven. Customers interact with call center agents, in-person bank tellers, or customer support representatives to resolve issues, inquire about services, or manage transactions. While these methods provide a personalized touch, they also come with significant challenges, such as:

- High operational costs: Human agents require salaries, benefits, and training, leading to substantial overhead expenses for banks.

- Limited availability: Traditional customer service is typically bound by working hours, often leaving customers without support during non-business hours.

- Inconsistent service quality: The quality of service can vary depending on the agent’s experience, mood, and workload, leading to inconsistent customer experiences.

- Long wait times: Customers frequently experience long hold times when contacting customer service, leading to frustration and dissatisfaction.

While human agents are invaluable for handling complex queries and providing personal touchpoints, these limitations have prompted many banks to seek more efficient solutions.

The Rise of AI Customer Service Bots and Virtual Assistants

With the development of AI technologies such as Natural Language Processing (NLP), Machine Learning (ML), and deep learning, banks are increasingly deploying AI-driven customer service bots and intelligent virtual assistants to address these challenges. AI customer service bots are designed to handle a variety of customer service functions, including answering frequently asked questions (FAQs), helping with routine banking tasks, and providing proactive financial advice.

These bots are constantly evolving, capable of learning from interactions, improving their responses over time, and delivering a more personalized customer experience. AI bots can be deployed across multiple channels—websites, mobile apps, social media platforms, and smart devices—enabling seamless interactions across various touchpoints.

Benefits of AI Customer Service Bots for Banks

1. Reducing Human Labor Costs

One of the primary benefits of implementing AI-powered customer service bots in banking is the reduction of labor costs. Traditional call centers and customer support operations require a large number of human agents to handle customer queries, provide information, and troubleshoot issues. These roles involve considerable ongoing costs in terms of salaries, benefits, recruitment, training, and management.

AI-powered customer service bots, on the other hand, can automate a significant portion of these tasks, drastically cutting down the need for human agents. For example, bots can handle routine inquiries like account balance checks, transaction histories, and basic troubleshooting, which otherwise would require the involvement of a customer support agent.

By automating these tasks, banks can optimize their human resources, allowing agents to focus on more complex or high-value interactions, such as assisting with financial planning or handling customer complaints. This reallocation of resources contributes to a significant reduction in operational costs.

2. Enhanced Efficiency and Speed

AI customer service bots are available 24/7, unlike human agents who have to work in shifts or follow regular business hours. This means that customers can get instant responses to their queries at any time of day or night. Whether a customer wants to check their account balance at 2 AM or make a payment on a holiday, AI chatbots are always on standby, ensuring continuous customer support without downtime.

In addition to their availability, AI bots also drastically improve response times. Where human agents might take several minutes to research an issue or provide a solution, AI bots can provide immediate responses to common inquiries, making the customer service process faster and more efficient.

This faster response time contributes to higher customer satisfaction, as customers no longer have to wait in long queues or hold for extended periods. The reduction in wait times results in a more seamless, enjoyable customer experience.

3. Improving Customer Engagement and Personalization

AI-powered smart advisors do more than just answer questions—they engage customers and provide personalized recommendations based on customer data and behavior. Banks can use AI systems to analyze a customer’s transaction history, financial behavior, and preferences to offer tailored advice or suggestions.

For example, an AI-powered assistant might recommend savings plans or credit products based on the customer’s spending habits or upcoming financial goals. These recommendations can go a long way in enhancing the customer experience and driving customer loyalty.

Moreover, AI-powered systems can anticipate customer needs by analyzing patterns in data. For instance, if a customer frequently spends money in a particular category, the AI assistant may proactively suggest relevant products, such as a credit card with cashback benefits in that category. This proactive service adds value to the customer’s banking experience and makes them feel that the bank truly understands their needs.

4. Increasing Accuracy and Reducing Human Error

AI systems excel at processing vast amounts of data quickly and accurately, reducing the likelihood of human error. In customer service scenarios, errors can occur when an agent misinterprets a query, provides inaccurate information, or overlooks critical details.

AI customer service bots, on the other hand, operate based on pre-programmed algorithms and machine learning models, allowing them to handle data with precision and consistency. For instance, when handling account-related inquiries, the AI bot can cross-check information across multiple systems and databases in real time, ensuring that customers receive accurate, up-to-date information every time.

This level of accuracy also builds trust with customers, who feel more confident that the AI bot will provide them with correct and reliable information, leading to a higher level of satisfaction.

Enhancing User Engagement and Satisfaction Through AI

1. Seamless Integration Across Multiple Channels

AI customer service bots are designed to integrate seamlessly across a variety of channels, such as mobile apps, websites, smart devices, and even social media platforms. This allows customers to interact with their bank using their preferred communication channel without having to switch to another platform.

For example, a customer might start a conversation with an AI bot on a bank’s mobile app, continue the interaction through social media, and finish it via a voice-enabled smart speaker. This omnichannel integration provides a consistent experience regardless of the medium, ensuring customers have a seamless journey.

Additionally, AI-powered bots can help customers navigate complex processes—like loan applications or account settings—by providing step-by-step guidance in real-time. This enhanced navigation simplifies the process for users, making their interactions more intuitive and enjoyable.

2. Proactive Customer Service

Rather than waiting for customers to initiate contact, AI-powered systems can offer proactive service by sending personalized notifications, alerts, and reminders based on customer behavior. For example, if a customer’s account is close to an overdraft limit, the AI assistant can proactively alert the customer and suggest solutions to prevent the issue.

This proactive approach leads to higher customer satisfaction because it prevents problems from escalating and makes the customer feel valued and informed. It also fosters customer loyalty, as clients appreciate the bank’s ability to anticipate and address their needs before they have to ask.

3. Building Long-Term Relationships

By engaging customers with personalized, intelligent interactions, AI customer service bots help banks build deeper, more meaningful relationships with their clients. Customers who receive relevant, personalized advice are more likely to feel a connection to the brand and view it as a trusted financial partner.

The ability to offer tailored financial recommendations, reminders, and guidance creates a sense of personalized attention that goes beyond traditional customer service interactions. This can lead to long-term customer retention, as customers are more likely to stay with a bank that understands their financial goals and consistently offers value.

Challenges and Considerations in Implementing AI in Banking

1. Security and Privacy Concerns

AI-driven systems in banking must be secure, as they deal with sensitive customer information. Cybersecurity threats are a constant concern for banks, and any AI-powered system must adhere to the highest standards of data security and privacy protection.

Banks must ensure that AI tools comply with regulations such as GDPR and CCPA, safeguarding customer data and maintaining trust. Implementing robust encryption protocols and adhering to data protection laws is critical to avoiding potential data breaches and ensuring customers feel confident in using AI services.

2. Maintaining Human Touch for Complex Issues

While AI excels in handling routine tasks and inquiries, there are instances when customers may require a human touch. For particularly complex or emotional issues, such as disputes or inquiries requiring negotiation, customers still prefer interacting with human agents who can provide empathy and understanding.

To address this, banks can adopt a hybrid approach, where AI bots handle routine inquiries, and complex issues are escalated to human agents. This ensures that customers receive the best of both worlds: efficient, automated service for simple queries, and personalized assistance for more nuanced concerns.

Conclusion

AI customer service bots and smart advisors are transforming the banking industry by reducing costs, enhancing efficiency, and improving customer satisfaction. Banks that implement these tools can benefit from faster response times, reduced human labor costs, and the ability to offer personalized, proactive service. However, the human element remains essential for handling complex or sensitive customer concerns.

As AI technology continues to evolve, its role in customer service will only become more significant. For banks, the key to success will lie in finding the right balance between automation and human interaction, ensuring that customers receive timely, accurate, and personalized service at every touchpoint.